Indian banks are currently considering the development of a special rating framework or model to assess the credit risk profile of startups (Source: https://www.businessstandard.com/industry/news/banks-considering-rating-framework-to-assess-risk-profile-of- startups-123092900209_1.html)

This is in response to the government's push for banks to play a larger role in funding startups, which are considered as key drivers of economic growth and innovation.

As per Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry, Government of India, a “startup” is defined as an entity, incorporated, or registered in India:

- up to a period of ten years from the date of incorporation/registration,

- whose turnover for any of the financial years since incorporation/registration has not exceeded one hundred crore rupees, and

- which is working towards innovation, development, deployment, or commercialization of new products, processes, or services driven by technology or intellectual property

A credit rating framework should use a combination of quantitative and qualitative factors to map the inherent risks accurately with the goal to provide a clear and transparent assessment of an entity's creditworthiness, helping investors, lenders, and the general public make informed decisions. There’s a need to develop a special rating framework for startups which would consider the unique characteristics of startups, such as their early stage of development, limited operating track record while promising anticipated high growth potential. It would also need to be flexible enough to accommodate a wide range of startups, from those in traditional sectors to those in rapidly evolving technology sectors. As such not much literature is available for credit rating of startups, not credit assessment by lenders which is focussed more on recovery of loan than probability of default.

We at MPFASL are attempting to provide our views on the possible approach to developing a special rating framework for startups. There is a need to modify the existing rating frameworks used for mature companies to accommodate the nuances of Start-ups. The key differences between startups and mature companies that would need to be considered are,

- Early stage of development: Startups are typically in the early stages of development, which means that they have a limited track record, with their business models still in evolving stage. This makes it more difficult to assess their risk profile using traditional rating frameworks as the future sustainability of the business model may not have reached to a level of stability.

- Limited financial data: Startups often have limited financial / operational data available due to their nascent stage of operations, which can make it challenging to assess their business performance and hence the creditworthiness. As a result, credit rating agencies for startups may use non-traditional data sources, such as certifications/IPRs, news and social media, and customer reviews, also to assess the risk profile of the startup.

- Greater emphasis on qualitative factors: For startups, there is a greater focus on factors such as the quality of the management team, the strength of the business model, and the market potential of the product or service.

Let’s understand this with an example. A bank has got two loan proposals: one from a 20-year-old auto component player supplying 2-Wheeeler switches (to an established OEM player) which has operating history, proven manufacturing capabilities, reputed clientele, loan history, strong profitability and net worth base. Another proposal is from a startup technology company with a new social media platform. As on date, the company has growing revenue but incurs losses, small but credible team, negligible tangible assets (apart from IT equipment) and has very limited financial data available. However, the company has a strong management team and a large and growing user base as well as technological capabilities.

Going by the traditional rating approach, our tech startup would never fair a good rating vis-à-vis the component supplier. This traditional approach is what banks must change. For startups, banks must incorporate a suitable credit assessment framework for startups.

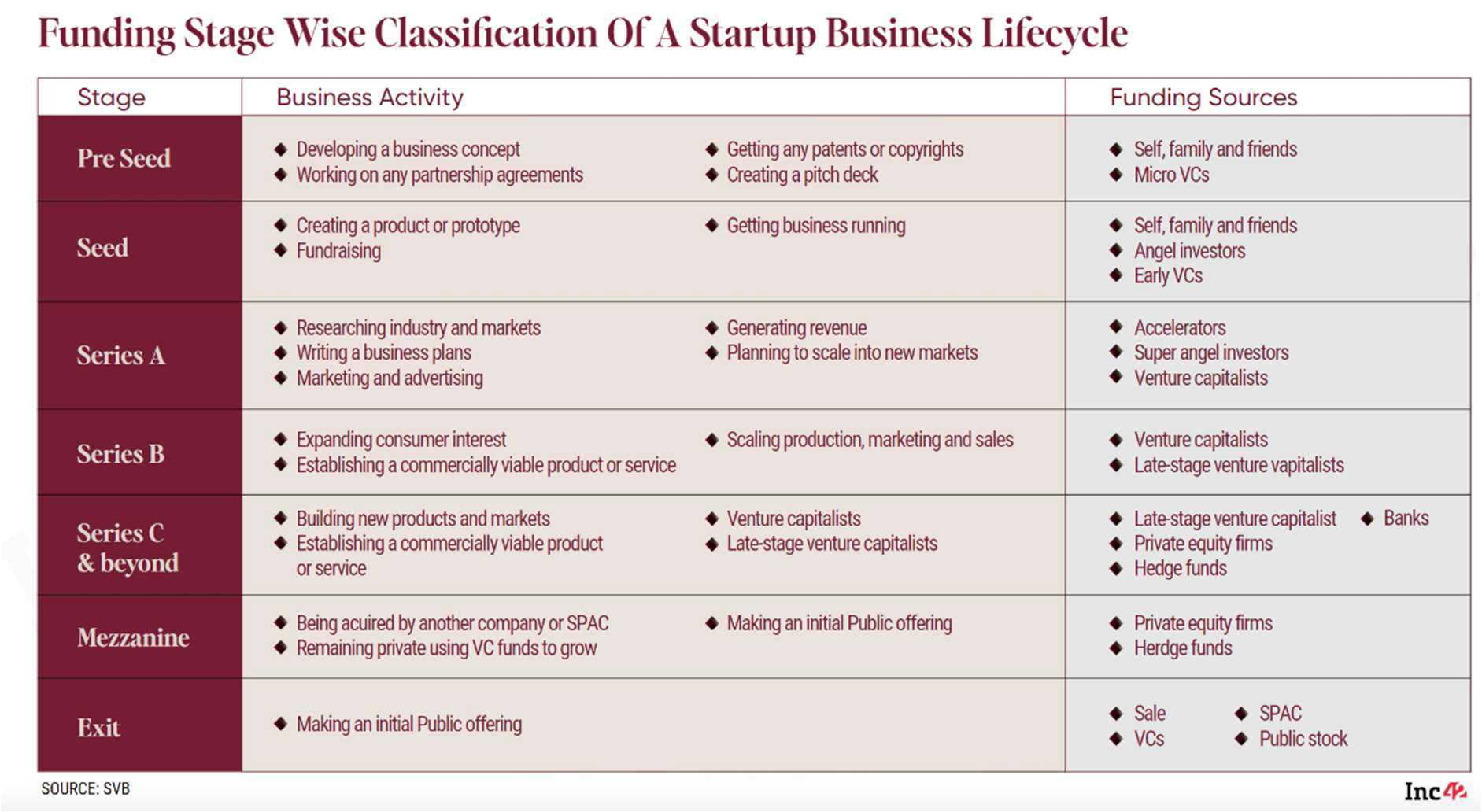

Funding for a startup commences from founders’ kitty and proceeds to angels, VCs, PE firms. Banks come at a very late stage in a startup (generally post series B), by when majority of equity is diluted but firm now has operating history, comfort of strong investor base, representation of experienced investors on board, etc.

MPFASL view on Credit Assessment of Startups.

The rating team at MPFASL, having accomplished credit risk consultancy of over Rs.2,80,000 crore, took the initiative to develop and implement for banks “credit rating framework for startups” which is a new arena for bankers who traditionally have dealt with matured businesses. A glimpse of what specific things we think should be looked at for startups from a credit rating perspective is as below:

Business Plan and Viability: Core of a startup is the business model: whether it’s providing a benefit or solving a problem. The viability of the business idea, the target market, revenue projections, and cost structure are assessed in detail. Every startup appears to be a unicorn on a worksheet; however, one needs to delve deep in business assumptions, questioning the variables and bringing out a realistic, or rather conservative, view with industry knowledge and experience.

Management Team: Banks’ evaluation of the management team is not new. In fact, a major comfort banks draw in a proposal is from the group/promoters and senior management team. However, startups can have founders who might not possess decades of experience or might not belong to business families. Still, the qualifications and relevant experience of founders and key personnel are considered, as strong leadership can provide better insights into the managing the startup’s risks.

Presence of investors: A startup which is backed-up by strong investors and their experienced professional representation on board gives reasonable assurance to lenders on the also crucial. Due diligence with the investors to support the startup from the initiation to stability phase can also provide a comfort to the credit profile.

Operating performance: Though a startup may take time to reach stage of profitability, cash flow analysis isn’t of much value. Unit economics is at the core of business analysis of a startup. The improvement in key performance metrics such as Gross transaction value (GTV), Customer Acquisition Cost (CAC), take rate, Customer Lifetime Value (CLV), Monthly Recurring Revenue (MRR), Net Promoter Score (NPS), Churn rate and many more depending on the industry and business need to be carefully examined and their behaviour over a period can be analysed.

Infrastructure sufficiency: Generally, startups aim for rapid growth in operations. This is to capture market share before competitors start copying the business model and canvassing clients. However, to scale up rapidly, the startup team should figure out and make provision for the required infrastructure (mostly leased for a new venture).

Market landscape: Banks might review market research and competitive analysis to understand the industry (SAM, TAM, etc) and market conditions in which the startup operates. Economic conditions and industry trends can influence the bank's decision. A strong business case in a growing industry is credit positive.

Legal and regulatory compliance: The rating framework should also check the compliance with all legal and regulatory requirements, including licenses, permits, and tax obligations. This is especially important in case of complex shareholding structure and overseas incorporated entities.

Credit Ratings- Impact on Startups

While a special rating framework for startups would be indispensable for banks, credit assessment can yield several benefits to businesses:

Independent business analysis: While each business has its own set of procedures and data points to monitor operating and financial performance, however, credit advisory firms, such as MPFASL, can bring a fresh perspective to crucial aspects of performance evaluation.

Increased access to finance: A special rating framework would help banks to better assess the risk profile of startups and would make it easier for startups to access finance.

Reduced cost of capital: A special rating framework could help to reduce the cost of capital for startups, as banks would be more willing to lend to startups if they had a clear understanding of their risk profile.

Increased investment: A special rating framework could help to attract more investment to startups, as investors would be able to use the ratings to assess the risk and potential return of their investments.

While we understand that each bank will work out its own credit assessment framework to evaluate credit risk properly and adequately, there are still some open questions.

- One is about limited collateral available. Will only PGs of founders and charge on cash flows suffice? This is so as the founders can be first generation entrepreneurs who will be having limited financial capabilities to acquire assets.

- Next, can any credit enhancement be sought such as shortfall undertaking from the institutional investors? This will be significantly boosting confidence of lenders on the deal and bring more accountability.

- Then, will the deal structure be clean debt or quasi debt (i.e, an element of equity) in case anything goes south? Though such structures might not be very helpful, given it can become a hard task for the lender to liquidate the startup’s shares (post conversion). Will the bank’s Risk Management Policy allow such structures?

- Finally, high risk perception would lead to higher interest cost. How would these high - cost funding tie-ups help the startups grow given they are in the stage of achieving operational breakeven? Should there be a willingness from lenders to look at a staggered RoI, in line with improving profitability of the startups?

Conclusion

The development of a special rating framework for startups in India is a positive step that would help to support the growth of the startup ecosystem. The framework should be designed to consider the unique characteristics of startups, such as distinctiveness of the product and services, early stage of development, limited track record, and high growth potential. It should also be aligned with global norms and best practices