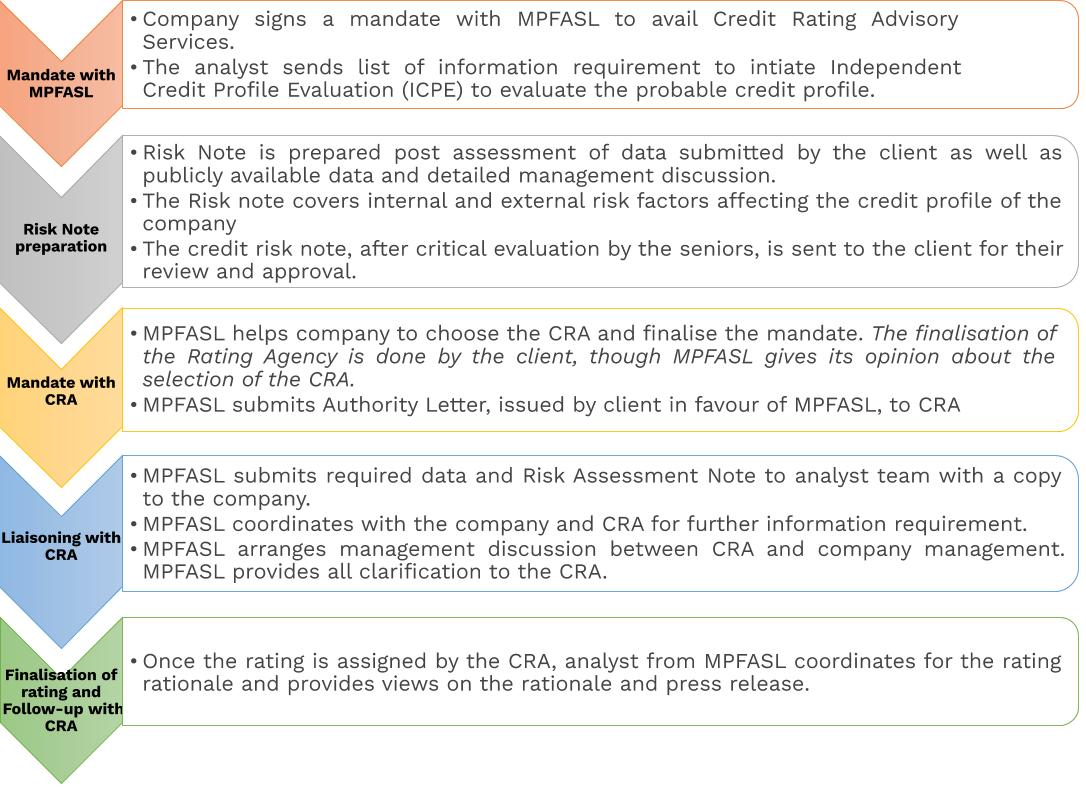

In India, third party assessment has gained immense importance. The implementation of Basel II saw almost entire banking portfolio getting an external credit rating. The banks are increasingly taking external credit rating into account while assessing the funding proposals. It has been highly necessary for the borrowers to be having investment grade credit profile to avail funding for the project as well as working capital. MPFASL provides end to end Credit Rating Advisory services throughout the entire Credit Rating Process. Right through evaluating Credit profile, MPFASL would –

In the dynamic business scenario, arriving at an accurate risk profile is of paramount importance to the Promoter as the deserving and right credit rating helps the company by way of –

There are several projects / company operations which have not been able to progress as anticipated due to lack of appropriate rating, as per the requirement of the lenders. As a result, the projects / company operations become unviable

Mr. Mahendra Patil – Founder & Managing Partner of MPFASL, has a strong Credit Rating assessment experience for about 14 years. He was associated with CARE Ratings during 2006-2013 where he has handled various rating proposal across sectors. Having developed credit rating methodologies for sectors such as Real Estate and Shipping / Shipbuilding, he was Member of the Internal Credit Rating Committee at CARE Ratings.

Besides, with credit rating consultancy experience of over 7 years, Mr. Mahendra Patil has provided Credit Rating Advisory services to over 200 corporate clients (over 380 assignments) covering cumulative debt profile of over 1,80,000 crore. Having a success ratio of over 95% and over 70% client retention ratio, he has handled assignments across 14-15 industry verticals.

We at MPFASL believe that the credit risk profile of a company can be improved over a period of time even in a challenging environment, with an adoption of a methodical approach towards credit assessment supported by our expertise generated thought long track record in handing various Credit Rating advisory assignments. However, MPFASL believes that nothing can be achieved in absence of consistent and targeted efforts of the management. The improvement in the risk profile would in-turn help companies reduce its cost of borrowings as well as reduce overall borrowing by efficient use of the internal resources.